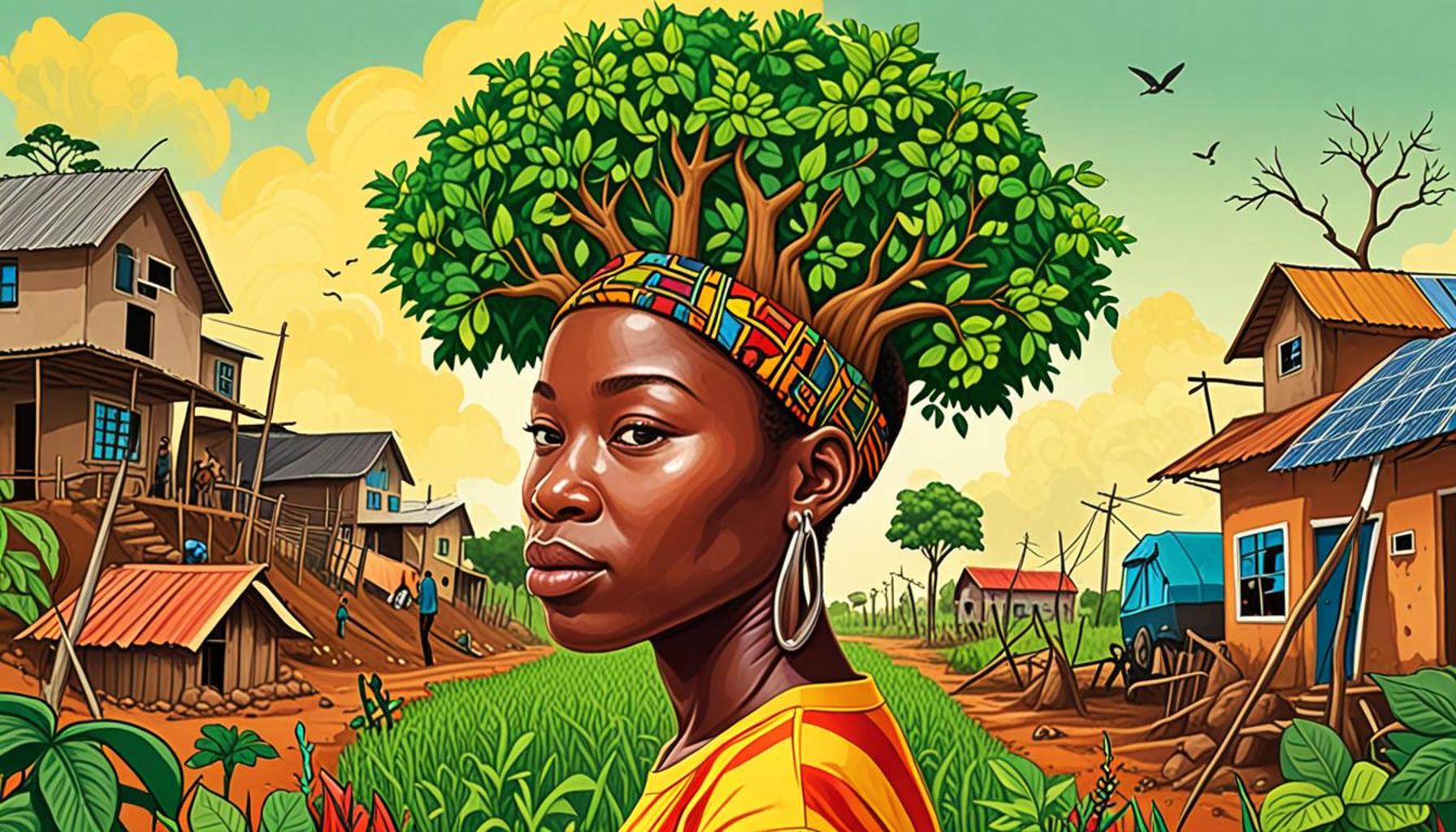

Growth Mindset and Financial Resilience: Strategies to Overcome Economic Crises in Nigeria

The Importance of a Growth Mindset

In today’s world, particularly in Nigeria, navigating economic challenges demands more than just basic survival skills. As the economy fluctuates, the concept of a growth mindset becomes increasingly vital. Individuals who cultivate this mindset view challenges as opportunities for growth rather than insurmountable obstacles. This perspective encourages individuals to embrace lifelong learning and remain open to change, fostering resilience in both personal and professional realms.

Financial Resilience Defined

Financial resilience is the ability to adapt and thrive despite financial setbacks. It empowers individuals and businesses to bounce back from economic hardships using strategic approaches. Financial resilience is not merely about surviving a crisis but developing the capacity to respond positively to it. In a country where economic fluctuations can be the norm, this characteristic becomes an invaluable asset.

Key Features of Financial Resilience in Nigeria

To achieve financial resilience, understanding and implementing specific strategies is crucial. Here are some core features that can significantly enhance one’s financial stability:

- Effective budgeting and financial planning: Establishing a realistic budget helps individuals and families allocate their resources wisely, ensuring they can cover essential needs while saving for unexpected expenses.

- Diversification of income sources: Relying on a single source of income can be risky, especially during economic downturns. By exploring side hustles—such as freelance work, online businesses, or agriculture—Nigerians can create multiple streams of income.

- Investing in skills and education: Continuous learning is crucial for adaptability. Whether through formal education or online courses, upskilling can open new professional opportunities and increase employability in a rapidly evolving job market.

- Building emergency funds: Financial experts often recommend having at least three to six months’ worth of living expenses saved. This cushion offers peace of mind and helps individuals handle unexpected situations without derailing their financial stability.

Combining Mindset and Strategy

To truly overcome the economic crises that regularly impact Nigeria, a combination of a growth mindset and targeted financial strategies is essential. The need for innovative thinking and adaptability is paramount, particularly during periods of inflation, unemployment spikes, or global disruptions like a pandemic.

For instance, during the COVID-19 pandemic, many Nigerian entrepreneurs shifted their business models to accommodate online sales and delivery, demonstrating how a growth mindset can lead to innovative solutions in difficult times. By embracing change and exploring new avenues, they not only survived but thrived in a challenging environment.

As we delve deeper into this topic, we’ll explore practical strategies tailored for Nigerians. These strategies not only foster a growth mindset but also enhance financial resilience in the face of adversity. Are you ready to discover how you can thrive amidst challenges? The journey to enhancing your financial resilience begins with understanding these concepts and taking actionable steps forward.

CHECK OUT: Click here to explore more

Strategies for Fostering Financial Resilience

To navigate the ever-changing economic landscape in Nigeria, individuals must arm themselves with strategies for financial resilience. This strategy involves embracing a proactive approach to personal finance while also cultivating a growth mindset. The interplay between a resilient mindset and sound financial practices can empower Nigerians to face economic challenges head-on and emerge stronger. Below are some practical methodologies that individuals can adopt:

- Establish Clear Financial Goals: It is crucial for individuals to set specific, achievable financial objectives. This can include saving for a child’s education, starting a business, or planning for retirement. Clear goals provide direction and motivate disciplined financial behavior.

- Educate Yourself on Financial Literacy: Enhancing one’s knowledge about personal finance can significantly impact decision-making. Understanding concepts such as interest rates, investment options, and savings strategies can equip Nigerians with the necessary tools to make informed choices that promote resilience.

- Regularly Review and Adjust Your Budget: Economic situations can change rapidly, making it essential for individuals to routinely reassess their budgets. Adapting to new circumstances allows for better allocation of resources, reducing the vulnerability to unforeseen financial shocks.

- Leverage Technology for Financial Management: With the rise of technology, various apps and tools can aid in managing finances efficiently. From budgeting apps to investment platforms, utilizing these technologies can simplify financial planning and foster better financial habits.

Moreover, building a network of support can play a significant role in enhancing financial resilience. Communities that share knowledge and resources provide a solid foundation for overcoming financial difficulties. Collaborating with others through local cooperatives or financial groups can also promote resource sharing and collective growth.

Adopting a Problem-Solving Attitude

Implementing a problem-solving attitude is crucial when faced with economic hardships. For instance, when confronted with job loss or decreased income, individuals can pivot their skill set to find freelance opportunities or part-time work. This adaptability reflects the essence of a growth mindset, as it encourages exploring alternative pathways rather than succumbing to despair.

In Nigeria, where economic challenges may arise unexpectedly, such as shifts in global oil prices affecting national revenue, building skills in demand can provide job security and diversification. The willingness to take on learning new skills can therefore translate into better financial stability and create pathways to greater economic opportunities.

Furthermore, engaging with relevant financial resources, such as workshops and seminars on entrepreneurship, can inspire innovative ideas and strategic thinking. These experiences not only cultivate a positive mindset but also equip individuals with real-world strategies to tackle financial crises.

As we continue exploring the vital connection between a growth mindset and financial resilience, the next sections will delve into how specific behavioral changes can enhance financial stability. By prioritizing adaptability and innovative thinking, Nigerians can create a robust defense against economic adversities.

Growth Mindset: A Pathway to Financial Resilience

In the context of Nigeria’s economic challenges, fostering a growth mindset is crucial for individuals and communities to thrive. This psychological approach emphasizes the belief that abilities and intelligence can be developed through dedication and hard work. It cultivates a love of learning and a resilience that is essential for success in unpredictable economic climates.

Benefits of Embracing a Growth Mindset

Embracing a growth mindset enables individuals to view challenges as opportunities rather than obstacles. For instance, during economic downturns, those who adopt this mindset are more likely to explore alternatives, such as entrepreneurial ventures or ups killing initiatives, that can provide additional sources of income. They are motivated to seek out knowledge and adapt to changing conditions, enhancing their financial resilience.

Strategies to Cultivate a Growth Mindset

1. Education and Skill Development: Investing in ongoing education, whether through courses on financial literacy or entrepreneurship, can empower individuals with the tools needed to navigate economic adversities effectively.

2. Networking and Community Support: Building connections with like-minded individuals fosters an environment ripe for sharing resources and strategies to overcome economic challenges. Participate in workshops and community groups that focus on economic stability and personal finance.

3. Mindfulness and Positive Thinking: Incorporating mindfulness practices can help shift negative thought patterns to more constructive ones, reinforcing a positive approach to problem-solving during times of financial strain.

| Category | Advantages |

|---|---|

| Adaptability | The ability to adjust strategies in response to economic demands strengthens financial security. |

| Innovation | Encourages creative problem-solving leading to unique business solutions that can thrive despite economic shifts. |

Building Financial Literacy for Resilience

Financial literacy is paramount. Knowledge about budgeting, saving, and investing equips individuals with skills to make informed decisions. Understanding credit, loans, and interest rates can demystify finance, empowering Nigerians to take control of their economic futures.

As we delve deeper into these strategies, it’s important to remember that developing a growth mindset is not just a personal journey but a collective responsibility that can uplift communities across Nigeria, bridging the gap in financial resilience against crises. By embracing change and cultivating resilience, individuals can position themselves for growth, even amidst challenges.

CHECK OUT: Click here to explore more

Harnessing the Power of Community and Collaboration

In order to build a resilient financial foundation, it is vital for individuals to leverage the strength of their communal ties. Historically, Nigerians have shown a remarkable ability to work together during periods of hardship. Community collaboration not only fosters a sense of belonging but also paves the way for shared growth and financial stability. Here are ways to harness the power of community:

- Participate in Savings Groups: Nigerians can benefit significantly from traditional savings groups such as “Esusu” or “Ajo.” These groups offer platforms for individuals to save collectively and access funds in times of need, reinforcing the principle of mutual support.

- Networking for Economic Opportunities: Establishing a network of like-minded individuals can lead to the discovery of job openings, investment opportunities, and collaborative ventures. Regular participation in community forums, social media groups, and local business associations can help unveil valuable resources.

- Sharing Knowledge and Resources: Hosting and attending local workshops focused on financial literacy, entrepreneurship, or skill development can boost collective knowledge. By engaging in knowledge-sharing sessions, communities can empower their members and foster innovative solutions to financial challenges.

- Creating Local Business Alliances: By joining forces, small businesses can offer bundled services or products that benefit the community. This approach not only fosters cooperation but also strengthens the local economy against external shocks.

Embracing Innovative Income Streams

The current economic climate in Nigeria encourages a shift from the traditional notion of sole employment to exploring multiple income streams. This adaptability encompasses various avenues that can offset potential loss from primary sources of income. For example, individuals can engage in side ventures such as online trading, tutoring, or crafting handmade goods.

The rise of the internet has opened up global markets, enabling Nigerians to sell products and services far beyond their local communities. Platforms like Jumia and Konga as well as freelance websites such as Upwork and Fiverr allow individuals to monetize their skills while establishing a personal brand. Thus, diversifying income potential becomes a proactive strategy for financial resilience.

Additionally, exploring agricultural opportunities can be life-changing in a country with abundant natural resources. Urban farming or partnering with local farmers to supply fresh produce can not only bolster food security but also stimulate the income of families and communities. As food prices fluctuate during economic downturns, individuals who engage in agricultural ventures can create a buffer against financial instability.

Developing Mindfulness in Financial Decisions

In times of economic uncertainty, it is crucial to practice mindfulness in financial decision-making. This means being consciously aware of one’s spending habits, investment choices, and savings patterns. By understanding emotional triggers that lead to impulsive financial behaviors, Nigerians can reframe their thinking and make more deliberate financial choices.

For instance, a mindful approach to budgeting includes tracking expenses over a month to identify non-essential items that can be reduced. This self-awareness extends to understanding the value of savings and investment, which encourages individuals to seek out information on where their money can grow, such as in local cooperative societies or real estate investments.

Implementing these strategies calls for resilience, adaptability, and most importantly, a continuous learning mindset. By intertwining community collaboration, innovative income streams, and mindful financial practices with a growth mindset, Nigerians can not only overcome current economic challenges but also build a robust framework for future financial stability.

LEARN MORE: This related article may interest you

Conclusion: A Pathway to Financial Empowerment

In conclusion, adopting a growth mindset is paramount for individuals in Nigeria seeking to navigate the treacherous waters of economic crises. The ability to view challenges as opportunities fosters resilience, encouraging proactive strategies and a robust response to financial adversities. By harnessing community ties, Nigerians can cultivate a sense of belonging that not only supports individual growth but also elevates the collective economic stability of their neighborhoods.

Embracing diverse income streams is another critical strategy that empowers individuals to mitigate risks associated with job loss or market fluctuations. The digital age has introduced endless possibilities for entrepreneurship, allowing individuals to explore innovative avenues and tap into global markets. Moreover, engaging in agricultural practices not only enhances food security but also serves as a reliable alternative source of income.

Furthermore, practicing mindfulness in financial decisions equips Nigerians with the tools necessary for sound budgeting, effective saving, and informed investing. Heightened self-awareness in financial matters is key to overcoming impulsive spending habits and building long-term financial health.

Ultimately, the integration of these strategies—community collaboration, diversified incomes, and mindful decision-making—forms the backbone of financial resilience in the face of economic uncertainty. By cultivating a growth mindset, Nigerians can transform adverse circumstances into stepping stones for sustainable economic success. As economic landscapes continue to evolve, let us remain steadfast in our pursuit of knowledge and adaptability, ensuring a brighter and more prosperous future for all.